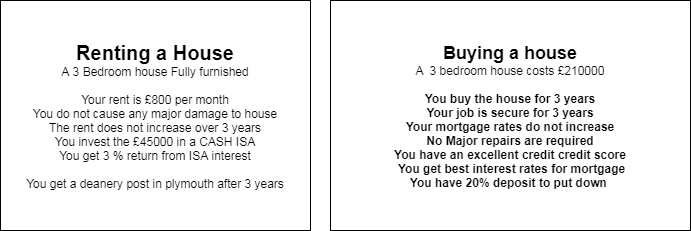

Paying the rent may sound like money down the drain but make sure you make a good calculation before embarking on this route..Let us look at a simplistic calculation. This calculation is based on the following assumptions

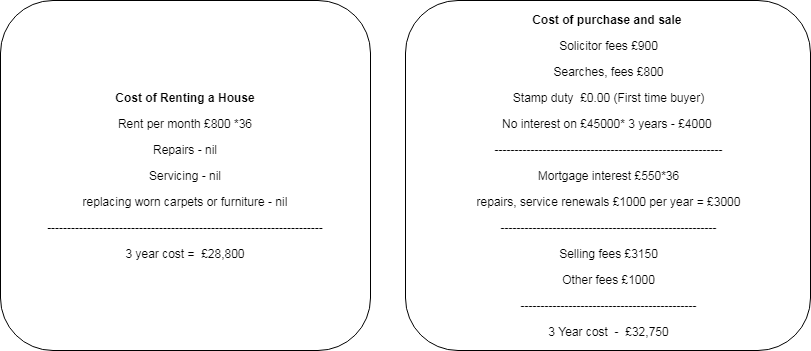

So it takes 3 years to make up the costs before you start making a profit if you purchase a house

Effectively you need to stay in the house for 3 years to break even. However ultimately it is a personal decision, your mortgaged house is your own. If you want to paint a wall flamingo red- you can do it. However even if you are renting you can still do this with permission.

Factors to consider

Buying a house is easy – You just need to put up the money

- House prices may go up – (benefit) or down (your loss)

- Without proper knowledge of the area you might be tempted by a low price because the seller wants to get rid of the house

- You might buy in the wrong area.

- You need to find at least a 20 % deposit (£45,000) as deposit, which is tied up till you sell

Selling is the big challenge

- The big stress is when you sell the house , where you will be paying mortgage with no tenants inside. You will go through viewing after viewing without offers and all this while you have to pay mortgage.

- The rental Trap You might thing it is easy to rent out. However you should be aware of the section 24 rule which means that you may more tax than you receive as rent. Read up about it. Plan for it.. read about it first and be aware..

- Can you meet your outgoings if you have no rent coming in?

BACK